If you sell drinks in containers over 150ml and under 3 liters in aluminum can or PET plastic containers with the Re-Turn logo on them with will are obliged add a recycling fee onto the sale of each container at the checkout.

If you sell drinks in containers over 150ml and under 3 liters in aluminum can or PET plastic containers with the Re-Turn logo on them with will are obliged add a recycling fee onto the sale of each container at the checkout.

How will the Re-Turn scheme work in eCommerce ?

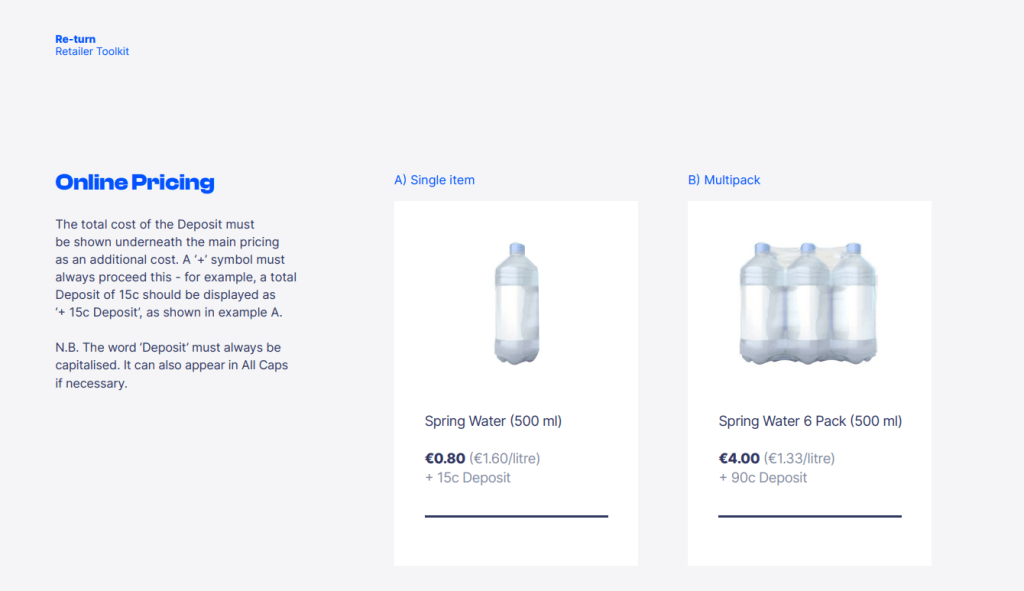

Websites will need to adhere to the price guidance. This means the price of the product and the deposit has to be shown on every place where the price is displayed.

Below is the guidance.

re-turn price display ( image courtesy of re-turn.ie )

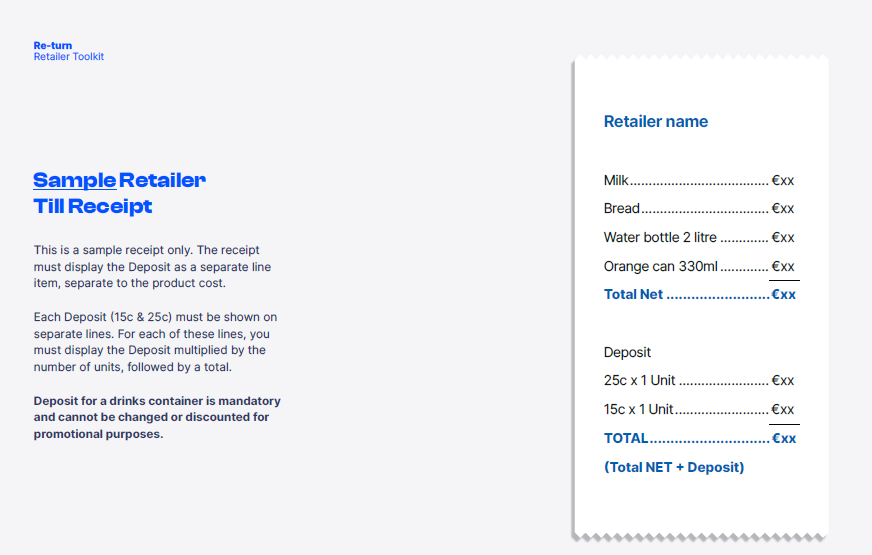

Re-Turn eCommerce receipt.

Re-Turn eCommerce receipt. In the checkout the amount of the sale that is “deposit” will be shown above the grand total.

You will need to show clearly in the checkout and receipt the itemized breakdown Price Inc Vat – Re-Turn. ( image courtesy of re-turn.ie )

How does it look like on a website.

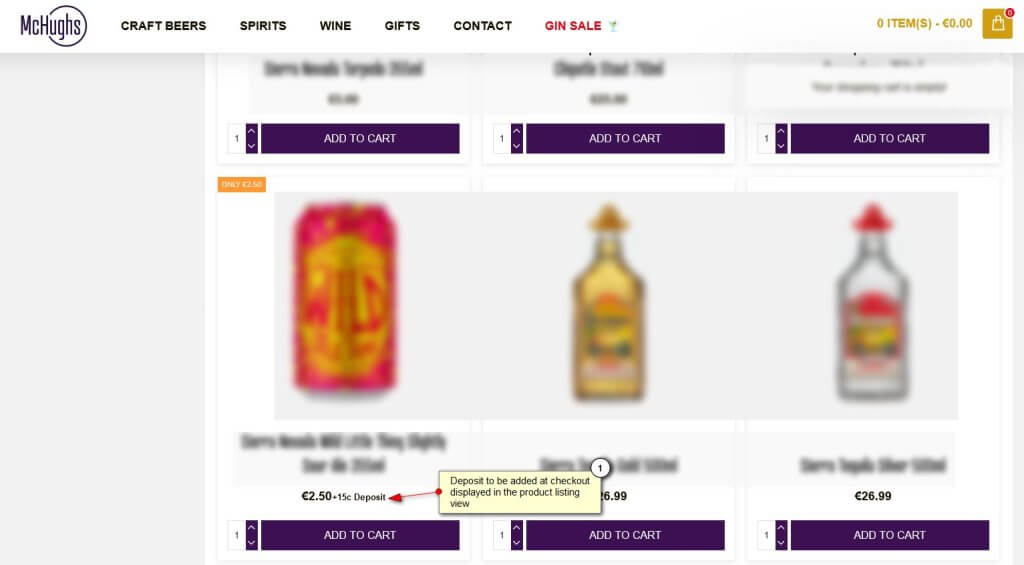

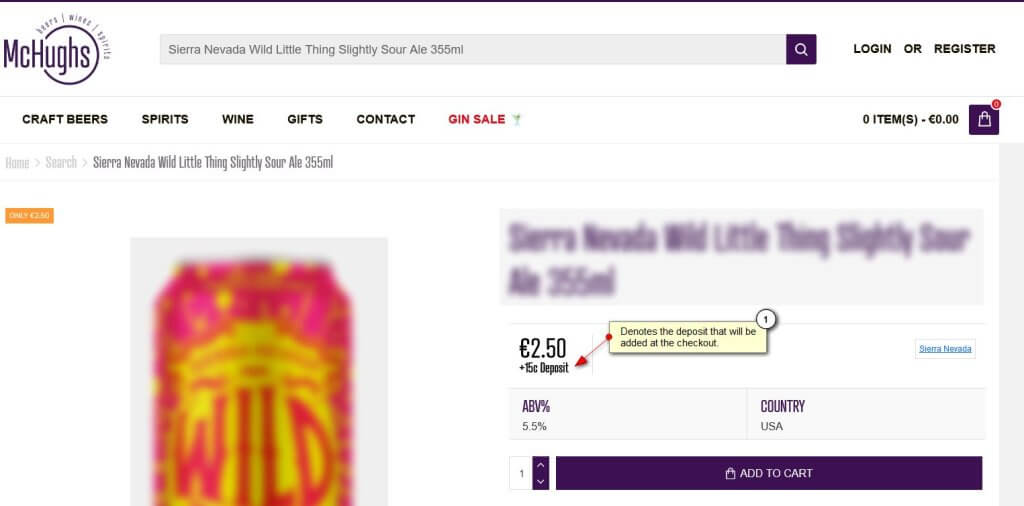

We are implementing this as shown in the images below.

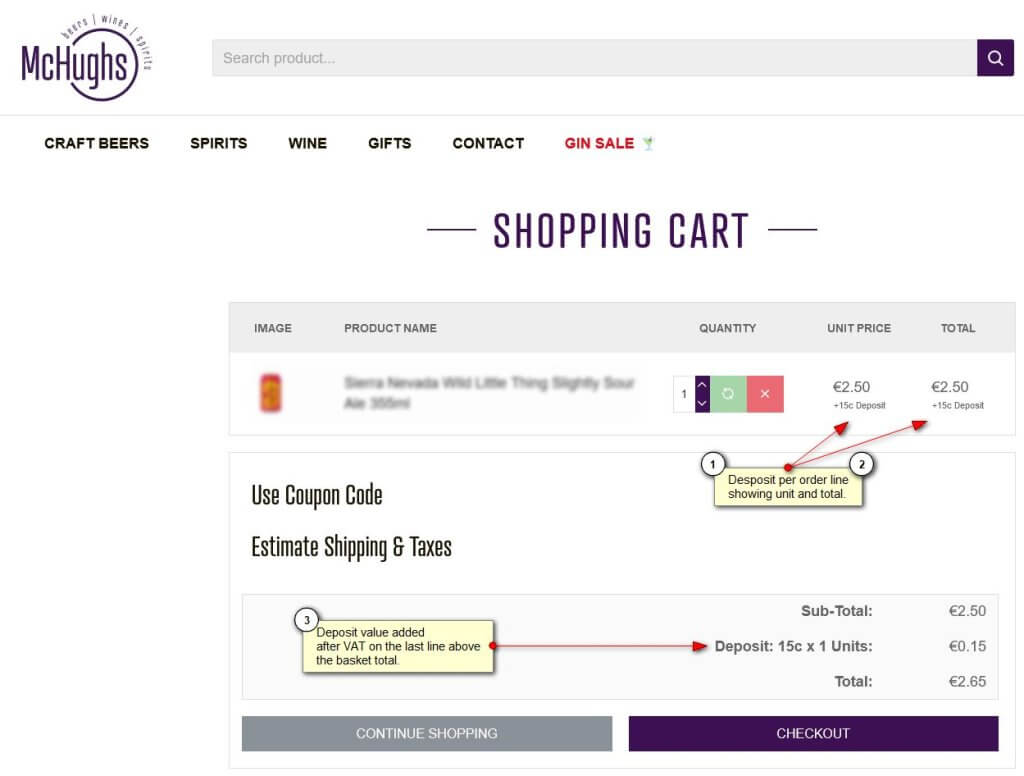

There are limitations in eCommerce checkouts on how this can be implemented and the following is the nearest that can be achieved to the guidelines.

Product Listing Page

Product Detail Page Example

Checkout Basket Example.

It is added after the Vat Line on the Order total ?

It is shown after the VAT line. There is no vat applied to the Re-Turn Levy.

The rates charged to the public will be.

15c and 25c per container depending on the size of the Plastic PET or Aluminum container.

No levies on Glass ( as 80% of glass is recycled already -Re-Turn do not see a need to levy this charge )

Examples are.

A standard 330ml can of Coke that might have cost €1.50 previously will now cost €1.65.

A four-pack of 330ml cans of Coke that retails for €4.90 at present will now be €5.50.

A four-pack of 750ml Evian water that retails for €4.39 at present will now be €5.39.

A 1.35 litre bottle of Innocent orange juice that retails for €4.99 at present will now be €5.24.

An eight-pack of 500ml Guinness draft beer that retails for €16 at present will now be €17.20.

( Rates correct as of 22/01/2023 )

So for eCommerce the surcharge will need to be defined at the product unit level, and the rate set in a settings table – so that if the rates change again its a 1 place change for the website owner.

The order total and the checkout order lines will need to be re-coded.

The levies and how it will operate in the retail environment is in an excellent article here

The list of qualifying barcodes has not yet been released by re-turn for eCommerce stores. We would expect this to be a public facing api so as developers can automatically update client websites and POS systems as new product is added. The reverse vending machines have this information so the data is available and in place – just not available to the public.

It is unclear as yet if online stores outside or Ireland selling beverages into Ireland with qualifying packaging will need to implement this directive.

Implementation live date is February 1 2024.

Images on this page are copyright of their respective owners.